How AI-Powered Analytics Transformed a Brokerage’s Trading Platform

GenBI Delivers 10x Faster Data Insights for Crypto Trading Firms Using Natural Language Queries

Allison Hsieh

Updated: Dec 18, 2025

Published: Jun 26, 2025

A fast-growing cryptocurrency brokerage revolutionized their trading operations by integrating Wren AI’s Generative Business Intelligence (GenBI) platform. The implementation eliminated traditional BI bottlenecks, enabling non-technical users to access real-time trading insights through natural language queries, resulting in enhanced client engagement and operational efficiency.

The Challenge: Breaking Down Data Silos in Crypto Trading

The brokerage needed a white label trading platform that could combine real-time trade data with client information to drive operational efficiency and improve customer engagement.

The platform had to provide intuitive analytics for traders and brokers while maintaining scalability and flexibility to adapt to market demands. Additionally, the brokerage wanted to empower its team with actionable insights without requiring extensive technical expertise.

The Solution

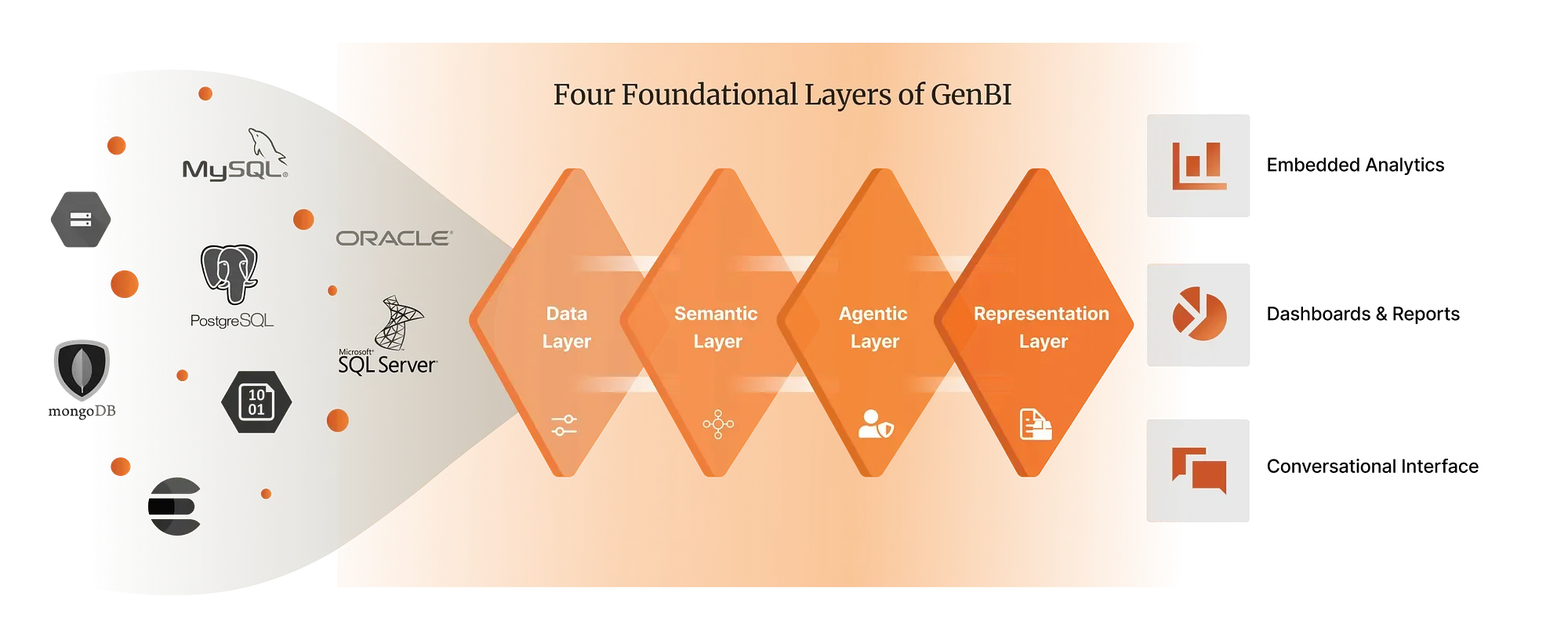

Wren AI’s Generative BI (GenBI) served as the cornerstone of this transformation. Its semantic layer bridged the gap between complex data structures and natural language queries, allowing non-technical users to gain valuable insights.

Wren AI’s semantic layer translated complex data structures into intuitive, business-friendly terms, allowing users to query data in natural language without needing technical expertise.

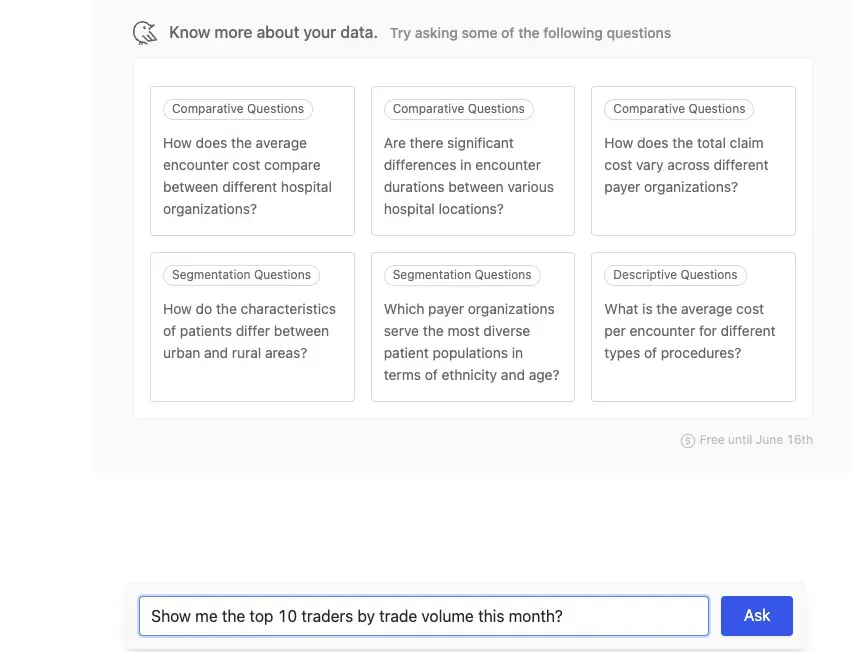

The user can easily (Text-To-SQL & Chart) query without relying on traditional BI tools (e.g., Tableau, Power BI, Looker) or manual data processes, involving SQL queries, data analysts, and static dashboards.

“Show me the top 10 traders by trade volume this month”

“Which clients haven’t traded in the last 30 days?” “What are the most popular trading pairs by order count this week?” “Show me support ticket trends for active traders this quarter.”

This streamlined, enhanced CRM customization by tailoring client interactions, and optimized marketing strategies through targeted campaigns based on real-time data…. No dashboard navigation. No waiting for reports. No “can you pull this data for me” Slack messages.

What Actually Changed with Wren AI

Unified Data Integration:

Trade data (orders, amounts, and pairs) and CRM data (client profiles and account details) were seamlessly linked, creating a holistic view of client activity.

Conversational Analytics with GenBI:

The platform’s GenBI interface enabled non-technical users to extract insights through simple, natural-language queries, reducing reliance on data analysts.

Real-Time Insights:

The system provided up-to-date analytics on trading patterns, client behavior, and market trends, empowering the brokerage to respond swiftly to opportunities.

Scalable Infrastructure:

The white label solution was designed to handle growing transaction volumes and client bases, ensuring long-term reliability. By leveraging the integrated trading platform and GenBI, the brokerage achieved significant improvements:

Enhanced Client Engagement:

Personalized CRM strategies, driven by GenBI insights, increased client retention and satisfaction.

Operational Efficiency:

Real-time analytics reduced the time spent on manual data analysis, allowing the team to focus on strategic initiatives.

Improved Decision-Making:

Brokers and managers accessed tailored insights instantly, enabling faster and more informed trading and marketing decisions.

Competitive Edge:

The platform’s advanced capabilities differentiated the brokerage in the crowded market, especially cryptocurrency, in attracting new clients.

Why This Actually Matters for Your Business

Most crypto brokerages are still stuck in the old model — hire analysts, build dashboards, wait for insights. Meanwhile, markets move in milliseconds and client expectations keep rising.

The firms winning right now aren’t necessarily the ones with the most data. They’re the ones who can act on their data the fastest.

When your competitor takes three days to identify at-risk clients, and you can do it in three seconds, guess who keeps more customers?

Wren AI’s GenBI isn’t just a BI tool, it’s an intelligent assistant for trading and client management.

Charting capability of Wren AI, just ask get results and charts.

Under the hood, Wren AI’s semantic layer does the heavy lifting — translating business questions into proper database queries automatically. It connects trading data with CRM data, handles the complex joins, and serves up answers in plain English.

The platform scales with transaction volume, integrates with existing systems, and doesn’t require your team to learn new tools. It just works.

What’s Really Changing in Fintech

This isn’t just about one brokerage getting better reports. It’s about a fundamental shift in how financial firms operate.

The old way: collect data → hire analysts → build dashboards → maybe get insights → hopefully make decisions

The new way: ask questions → get immediate answers → make decisions → repeat

Companies still building data teams and complex BI infrastructure are solving yesterday’s problems. The winners are the ones making data access as natural as having a conversation.

Ready to Stop Waiting for Your Data Team?

If you’re tired of being three steps behind your own business, it might be time to let your data speak for itself.

Ready to transform how your organization accesses data? Request a demo or start your free trial at getwren.ai

Supercharge Your

Data with AI Today

Join thousands of data teams already using Wren AI to make data-driven decisions faster and more efficiently.

Start Free TrialRelated Posts

Related Posts

Beyond Dashboards How Conversational AI is Revolutionizing Structured Finance Analytics

How Wren AI transforms complex financial data into instant, actionable insights through natural language — no technical expertise required

Unlock CRM Superpowers with Generative BI Real-Time Insights, Natural Language Queries, and Seamless API Integration

Transform your CRM from static dashboards to dynamic, AI-powered analytics using Wren AI’s GenBI APIs — deliver instant, personalized insights without technical bottlenecks.

Less Waiting, More Winning How Smart Marketing Agencies Use AI to Drive Results Faster

Replace slow BI dashboards with conversational analytics. Ask questions in plain English and get CTR, CPC, and ROAS metrics visualized in seconds.